Finance parts, take on more work, get paid. Repeat.

Parts procurement finance

Solve your cash flow problems with Praxis

Tailored Financial Solutions for your Business

Traditionally, motor body repairers have had to fund the entire working capital cycle of an insurance claim.

From undergoing rigorous credit checks with suppliers before opening an account to being constrained by credit limits, or having to pay on COD terms, many operators in the industry often feel the pinch from the get-go.

With final settlement only taking place once the job is complete, the cash flow crunch can have a real impact on their ability to take on more work. And grow.

But cash flow is not the only concern. Praxis also assists with dealing with multiple suppliers and insurers, each with their own specific administrative requirements.

Streamline your admin process

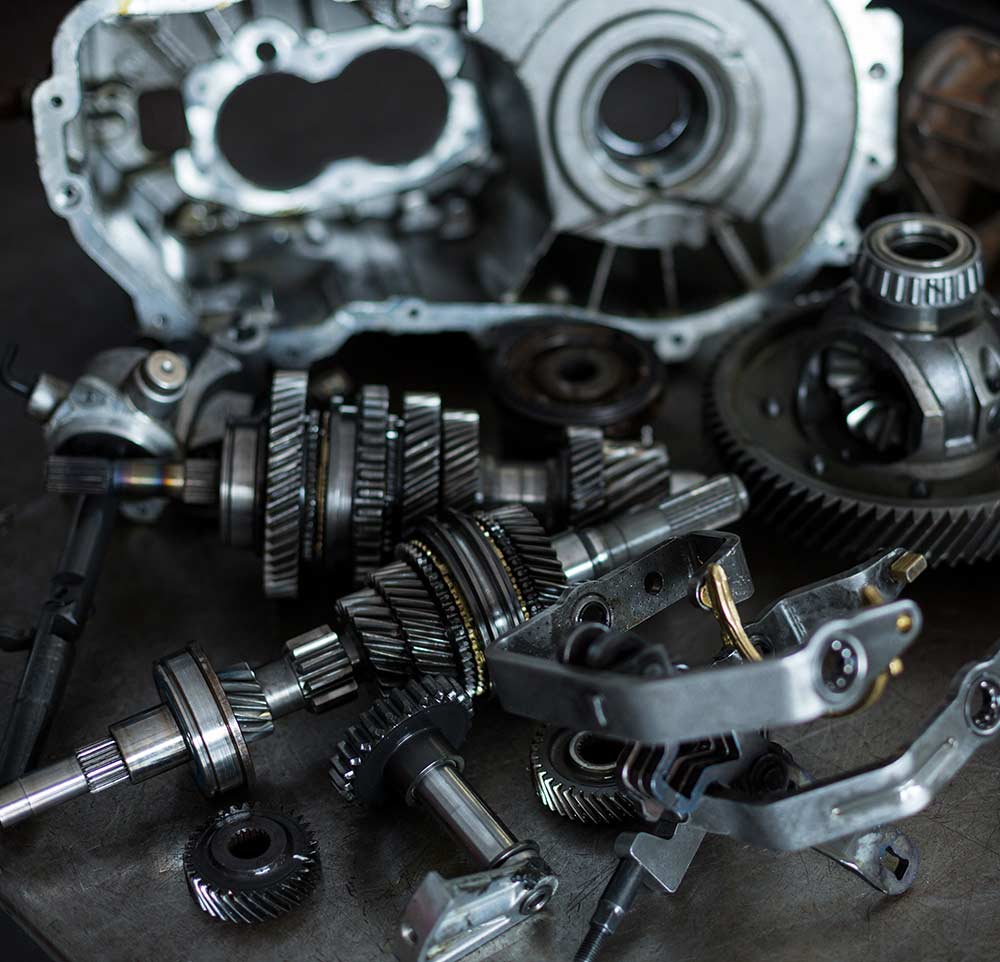

Simplifying parts finance

Praxis solves this cash flow problem by providing financing for parts.

We streamline the admin process for motor body repairers, working directly with suppliers. We also assist with ensuring that each claim is submitted properly to the insurance company to avoid any payment delays. This enables our clients to take back their time and focus on their core business, ensuring that their job is done right and on time.

This enables panel beaters to take back their time and focus on their core business

Seamless and efficient parts management

Technology-based. Client-focused.

Our parts procurement and claims handling software positions Praxis as the leading parts funding company in South Africa.

“

Don’t let cash flow constraints limit your business

How do I apply?

Simply complete the form below and one of our friendly team members will be in touch.

They will provide you with all the necessary documents and answer any questions you may have.

Open Hours

Monday to Friday:

8am - 5pm